DJI just released a firmware update for the Mavic 2 Pro on Wednesday, April 17, 2019. You should update your firmware as soon as possible because this will fix the geolocation issue that has been doubling data processing times.

Our Guest Column in Point of Beginning, September

The co-founders of Aerotas were featured as Guest Columnists in this month’s Point of Beginning magazine. The focus of the article is on the critical steps in developing a survey drone program. The article covers the crucial categories of technology (hardware and software), operations, insurance, and regulation. In our experience, operations and workflow management are the most critical but over-looked component in ensuring a successful program.

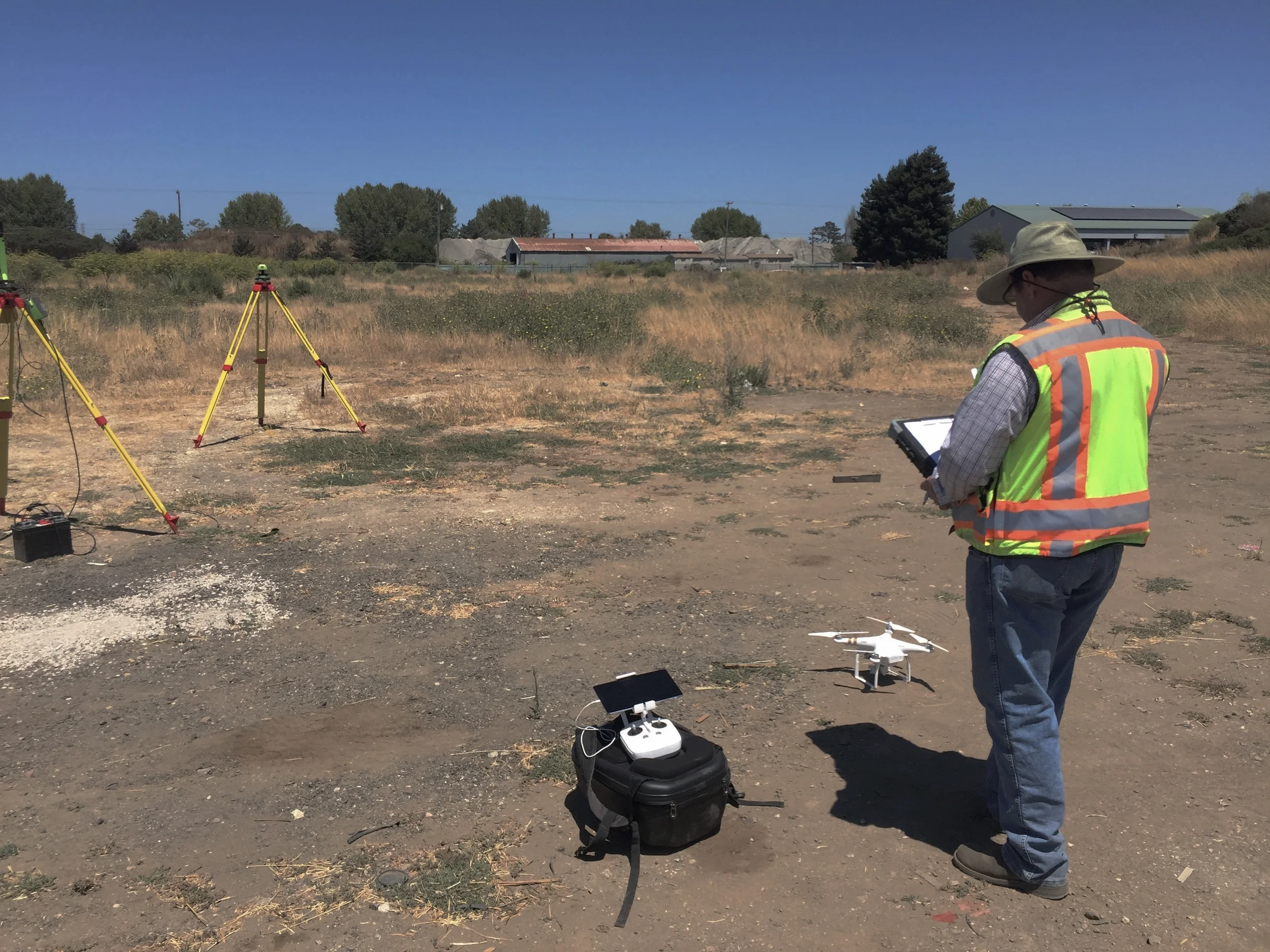

What a Surveyor Needs to Know to Start Mapping by Drone: The Technology

In our article in California Surveyor Magazine, “What you need to know to determine if UAVs are right for your survey business,” we identify the key factors that land surveyors must consider when deciding whether to begin using survey drones as part of their business. In this post, we will dig in to the first topic that a surveyor needs to understand before deciding whether to start using a drone for aerial mapping: the basic stack of survey drone technology.

A Snapshot of the Drone Industry: UAS Mapping Reno

We at Aerotas have spent the past 3 days at the UAS Mapping conference in Reno, Nevada. In addition to a deluge of information about surveying, photogrammetry, and image processing, we got to meet many of the companies that are working in this industry today. It provides us with an interesting snapshot of the types of firms involved in actually using drone technology, and all of the specialties that it takes to make this technology profitable. Below is a snapshot based on the 50 firms that were exhibiting at the conference. There are definitely some companies here that didn’t exhibit, and this certainly doesn’t represent the entire commercial drone industry, but it can provide some valuable insights about the industry as a whole.

Exhibiting Companies at the UAS Reno Conference

The most obvious takeaway from the above chart is the balance in the industry between hardware manufacturers, software manufacturers, and support companies, which include drone operators, consultants, and trade groups, among others. Many of these firms are highly specialized, like some of the data processing firms that analyze survey data for operators. It suggests that a fully vertically integrated firm that tries to build their own drone, autopilot, sensors, data processing software, and then run the operation on the ground, will face huge challenges from the more modular options out there. In this industry, it will make more sense to specialize on a specific part of the industry rather than the full value chain.

Hardware Manufacturers

Software Developers

Support Companies

Drilling into the data a bit deeper we get hints of where most people think a lot of the value in the UAS industry is. Of the 20 hardware manufacturers, over half made complete aircraft, while 7 only made sensors, and only 4 companies sold individual aircraft components like flight computers, suggesting that a lot of people see value in complete hardware systems. On the software side, nearly all firms were involved in data post-processing, primarily image stitching and 3D modeling. Only 2 firms offered flight computer and navigation software. The support industry was more varied, with a wide selection of service providers, consultants, and other firms like industry advocacy groups, schools, and trade magazines.

The most important thing that can be gathered from this data is actually what is missing. Of the 50 firms presenting, there was not a single firm focusing on legal compliance, regulatory management, or workflow management. It shows that these functions, while critical to the industry, are often overlooked by practitioners and end users of UAS technology. There are many good companies out there, like Skyward or Rupprecht Law, that address these industry needs. However, though both firms were in attendance, neither had a booth in the exhibit hall.

There is no question that this data set is incomplete. In fact, it isn't even a complete list of the companies that attended the conference. It does, however, show what the industry currently does, and does not, choose to focus on. Hardware manufacturing and software data processing are hot and very competitive. Support industries, especially legal and professional services, are not getting much attention. They are, however, as critical to safe, legal, and profitable operations as any good piece of hardware. Lets hope the the industry eventually catches on to develop a full suite of functions to grow to its full potential.